Budgeting is the number one tool that I used to pay off $35,000 in student loan debt on a $37,000 salary in just under two and a half years. And the biggest thing I had to figure out was how to calculate the income needed based on the following budgeted expenses I had every month. So I’m going to teach you the very basics of how to put together a budget for the very first time. Step-by-step guide to calculate the income needed based on budgeted expenses.

If you’re a beginner, this is for you. We’re going to be talking about how to put together a budget for the very first time.

Table of Contents

ToggleStep 1: Calculate Your Monthly Income

When you are starting your budget for the very first time, let’s just keep it simple.

The first thing that you’re going to do is you are going to list out your monthly income. If you don’t know how much money you bring in every single month, you can go back into your bank account statements and look up how much your paychecks are. And if you’re an hourly worker, you may want to take a look at the average of the last three months of pay just to see exactly how much you’re bringing in on average.

So let’s say this is $3,000 per month.

Step 2: List All Your Debts and Minimum Payments

Next thing you are going to do is list out all of your debt. So this would include things like student loans, credit card debt, personal loans, car loans. You are going to list out everything, and you are going to list out your minimum payments because we know that at least you have to pay the minimum payment every single month.

And here’s what I learned the hard way – missing even one minimum payment can mess up your credit score badly. Plus you get hit with late fees that just make everything worse. So when you’re writing down your budget, these minimum payments have to be there. They’re not optional.

Step 3: Identify Your Fixed Expenses

these are all of your debts and these are the minimum payments that you have to make every single month. Then the next place that we are going to go is our fixed expenses.

So fixed expenses could include things like rent, food, utilities, insurance, gas. If you don’t know how much you pay for food, utilities, insurance and gas, you can go back in the last three months of expenses either through your bank account statement or your credit card statement, add up those numbers, and then take an average across those three months. And that’s going to help you determine exactly how much you are going to spend.

You can guesstimate here if this is your very first time putting together a budget. If you think you spend around $300 on food, put $300 down, and then the next month you are going to track exactly how often you’ve gone to the grocery store, ordered takeout, and you’re going to add that in.

Now one note about food is that I do put groceries under fixed because I know I’m going to be buying groceries every single month, whereas restaurants and takeout and delivery and things like that would actually go under my fun expenses.

Your fixed expenses are basically the stuff that doesn’t really change. Your rent is what it is. Your insurance bill stays pretty much the same. That’s why getting these numbers right is so important when you start.

Step 4: Track Your Fun Money

So fun would be your next category when you are starting your budget. This would include things like restaurants, clothing, shopping, subscriptions, things like Netflix, Amazon Prime, Spotify, iTunes, whatever your subscriptions are every single month would go under fun because the subscriptions are not a necessity. They’re nice to have.

And so you’re going to again go back into your bank account statement if you don’t know how much you’re spending on any of these items, add them up for the month and then include them here or take your best guess.

Now as you are filling out these three different sections, the debt, fixed and fun, you want to make sure that all of these items are less than what you are bringing in because you want to make sure you’re not overspending your income. Let’s say all of these added up to $4,000 but you’re only bringing in $3,000. That means you’re overspending by $1,000 and that’s where things in the budget can change.

I’ll tell you what happened to me – I went through my bank statements and found out I was spending almost $150 a month on subscriptions I barely used. Like I had three different streaming services and I was only watching one. That was a wake up call. Go through every single charge and see what you’re actually using.

Step 5: Plan for Future Savings

Now the next category that you’ll want to pay attention to is the future. And the future includes any type of savings that you might be working up towards, maybe it’s a new car, a house or vacation, whatever it may be. You can definitely add in your future savings categories right inside of your budget so that we can keep track of those financial goals every single month.

Even when I was drowning in debt, I still saved a little bit every month. Maybe $25, maybe $50. Because stuff happens. Your car breaks down, you need new tires, something comes up. If you don’t have any savings at all, you end up putting that emergency on a credit card and then you’re back where you started.

Step 6: Add a Fudge Category (Your Budget Buffer)

You’ll also want to create a section for fudge. Now fudge is not chocolate, but I guess it could be. But fudge actually means this is your buffer inside of your budget in case you overspend in a different area. So this is like oh fudge I forgot that I need to buy mom a gift. And so you can create a buffer here of let’s say like $50 and if you go over or you forget about something else that’s not included in the rest of your budget you can pull from your fudge category. This is your buffer here.

This was a game changer for me. Before I had the fudge category, every time something unexpected came up I felt like I failed at budgeting. But life doesn’t work that way. There’s always something – birthday gifts, wedding showers, office collections, whatever. Having that buffer saved my sanity.

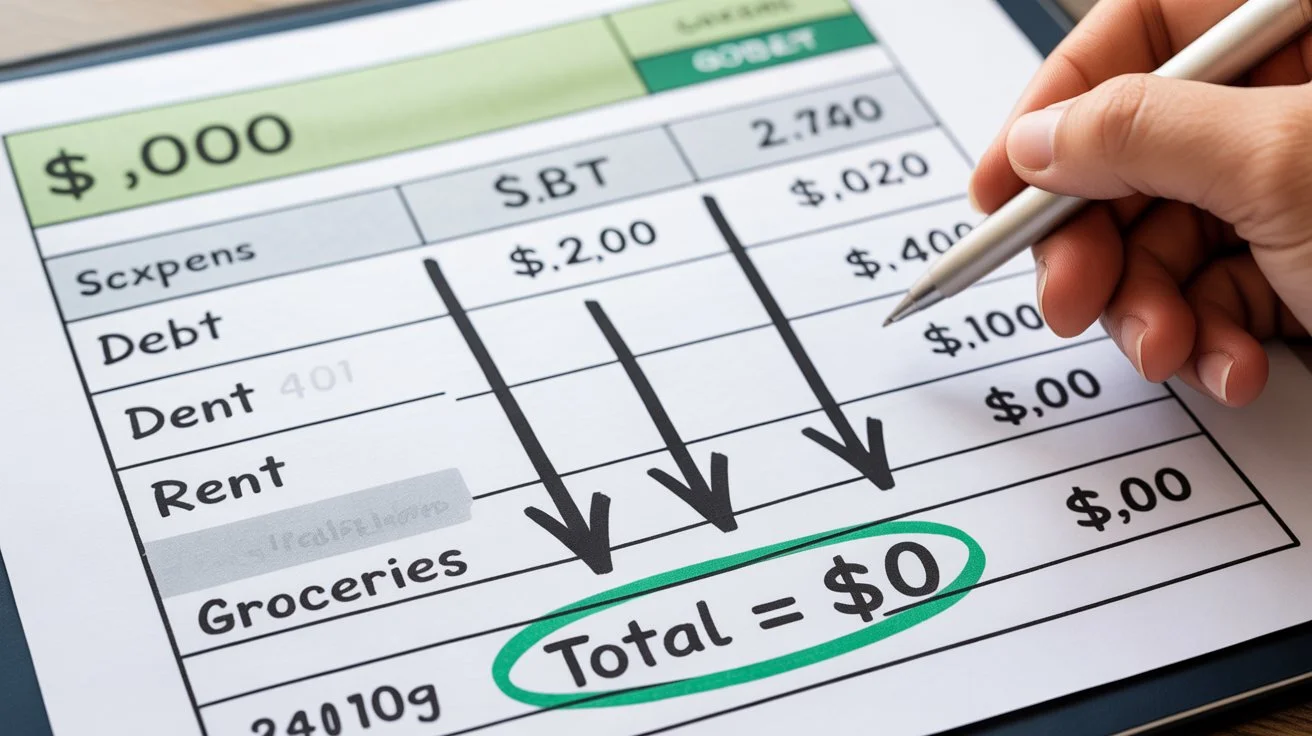

The Zero-Based Budget Formula

Alright, the last thing that you want to do when you’re making your budget for the first time is once you get all of these basic subcategories filled out, you want to add them up, add them up with your minimum debt payments and make sure that your total monthly expenses is less than your income.

And ideally you would want this to come out to a zero-based budget. So that means our income minus expenses is zero. And the reason why we want it to be zero is because anytime you have money left over, chances are that money either gets spent, missed, it’s forgotten about. But in most cases it gets spent and it needs to be allocated somewhere. That’s what becomes purposeful budgeting for you. So every dollar should have a name inside of your budget.

Now if this ends up being a negative number up here, so if your income and expenses, if this was like $4,000 as I was saying, then you’re negative $1,000 in the hole. That means you’re overspending and something needs to be adjusted inside of your budget.

And that’s a basic basic rundown of how you put your budget together.

What Happens When You’re Spending More Than You Make

So you added everything up and oh no – your expenses are more than your income. Don’t panic. This happens to a lot of people when they first write everything down. You probably didn’t even realize how much you were spending until you saw it all in one place.

You’ve got two choices here. Make more money or spend less money. Sometimes you gotta do both.

For making more money – can you work extra hours? Pick up a side hustle? Sell stuff you don’t need? When I was paying off debt I did freelance work on weekends. It sucked but it helped.

For spending less – you gotta be honest with yourself. What can you actually cut? Do you need all those subscriptions? Can you cook more instead of ordering food? Can you get a cheaper phone plan? I’m not saying live like a monk but there’s usually something you can trim.

The goal is to get your expenses lower than your income. That’s how you stop living paycheck to paycheck.

Your Budget Changes and That’s Okay

Nobody tells you this but your budget isn’t permanent. It’s gonna change all the time. You might get a raise. Your rent might go up. You pay off a credit card and suddenly you have more money. Your car insurance goes down because you got older.

Every couple months sit down and look at your budget again. Are the numbers still right? Are you spending what you thought on groceries? Did your electric bill go up because it’s summer now?

I look at my budget every single month. Some months I spend more on gas. Some months groceries cost more. That’s just how it is. You’re not trying to be perfect. You’re just trying to know where your money goes and make smart choices about it.

Ready-Made Budget Tools to Get Started

So that was obviously a very basic breakdown of how you put your budget together. Now I personally use a Google spreadsheet and you can use one too to track your income and expenses every single month. Budgeting has been such a great tool for me not only to pay off debt but now to hit my financial goals.

There’s a bunch of free budget templates online. Pick one that works for you and actually use it. Some people like apps, some people like spreadsheets, some people still use paper and pen. Doesn’t matter as long as you’re tracking.

How Businesses Budget ( This Matters for You Too)

Okay so now let’s talk about how businesses do budgets. You might be thinking why do I care about business budgeting? But actually it’s pretty similar to personal budgeting and understanding it helps you think about your own money differently.

Businesses have to figure out the same stuff we just did – what’s coming in, what’s going out, how much they need to make to cover everything.

Let me show you a real problem from an accounting test because it shows you how to think about fixed costs and break even points.

Understanding Business Budget Problems

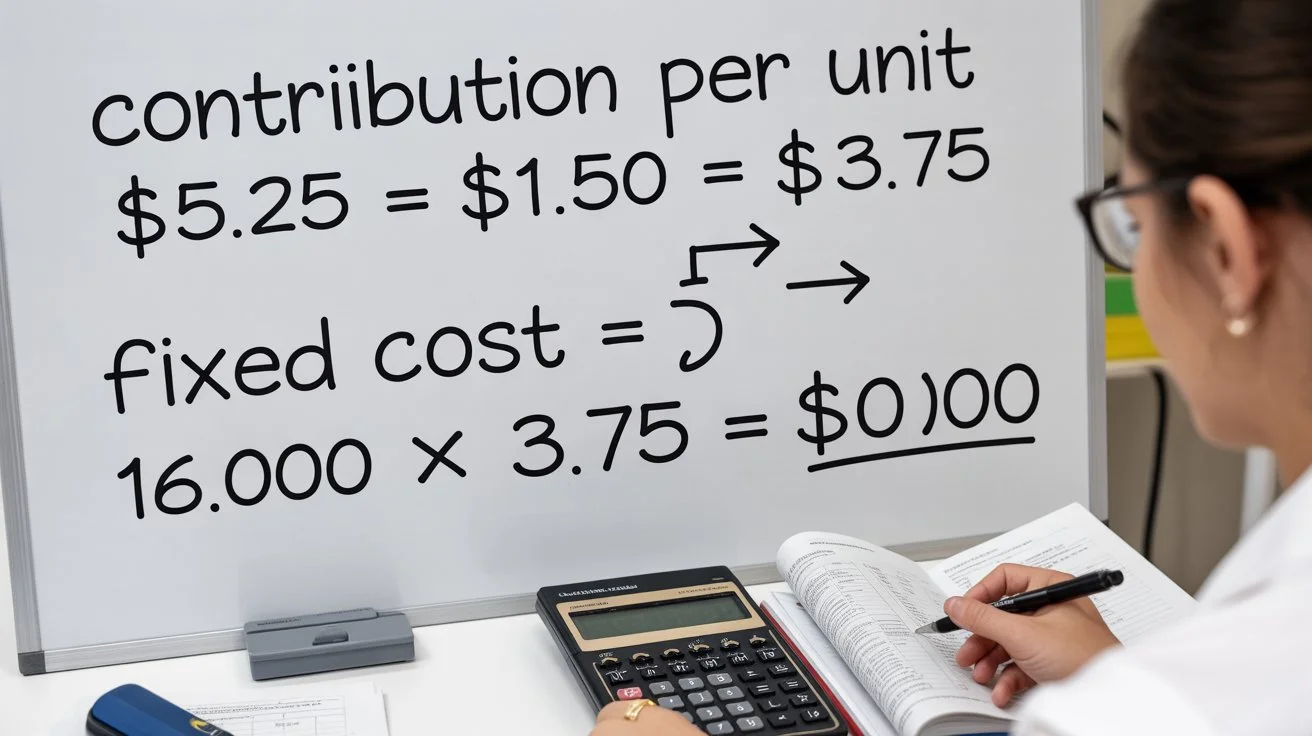

Okay, here look at the question. This question actually is taken from Cambridge A level accounting past papers. So look at here what is said, the following budgeted data is available for the year ending 31st December 2018.

Okay, so selling price is given $5.25 per unit, then direct materials $0.50 and then direct labor $0.75 and direct expenses $0.25.

Okay, so here the break-even point is 16,000 units. So that means you have to calculate the budgeted fixed cost for these 16,000 units. Okay.

Calculate Contribution Per Unit

So here first of all we have to calculate the contribution per unit.

So how to calculate contribution per unit? We know contribution per unit equal to per unit. Okay, equal to selling price, selling price minus direct materials plus direct labor plus direct expenses.

Okay, so we have in this question the selling price, we have direct material, direct labor and direct expenses. So now we will put this value here in this formula. So let us write here selling price which is $5.25. Then we have here direct material is there $0.50. Okay, then direct labor is here $0.75 and then we have direct expenses here $0.25.

Okay, now if you add this what we get? $5.25 minus if we add this it is $1.50. Okay, now if we subtract these two values here what we get? We get $3.75 per unit. Okay, so this is the contribution per unit. Okay.

Calculate Budgeted Fixed Cost

Now we will calculate the budgeted fixed cost for this 16,000 units. Yeah, so we know budgeted fixed cost equal to fixed cost equal to break-even point units, units multiplied by contribution per unit. Okay, so let us write here a contribution per unit.

Okay, so here the question already we have break even point unit which is 16,000 units. So let us write here 16,000 units. Okay, multiply by contribution per unit we already calculated. What is it? $3.75. So let us write here $3.75.

Now if we multiply 3.75 by 16,000 what do we get? If you say it is $60,000 you are correct. So this is how you have to calculate budgeted fixed cost. Okay.

Key Formulas to Remember

This is very simple if you understand. If we know these two formulas, okay, one is contribution per unit and then here budgeted fixed cost—okay, these two rules you have to know. So practice this and you’ll understand some more questions for your better understanding.

You’re probably wondering why I just showed you all that business accounting stuff. Here’s why – your personal fixed costs are like a business’s fixed costs. Your rent, insurance, debt payments – those don’t change. They’re there every month.

And just like a business needs to sell enough to break even, you need to earn enough to cover all your expenses. That’s exactly what we mean when we talk about how to calculate the income needed based on the following budgeted expenses.

Whether it’s your personal budget or a business budget, it’s the same idea. Know what your fixed costs are, know what your other expenses are, make sure you’re bringing in enough to cover it all, and have a plan for when things don’t go perfect. That’s budgeting.

Frequently Asked Questions About Budgeting and Income

How to calculate income for a budget?

Add up all the money you bring in every month. Check your pay stubs to see what actually hits your bank account after taxes. If you’re hourly, look at your last three months of paychecks, add them up, and divide by three. That’s your average. Don’t forget side gig money or anything else that comes in. You just want to know the total you’re working with each month.

How to calculate income from expenses?

This is backwards – you don’t calculate income from expenses. You add up all your expenses first, and that tells you how much income you need to bring in. So if your rent, bills, food, debt payments, everything adds up to $3,500, you need to make at least $3,500. If you’re making less, you’re going into debt.

What is the formula to calculate income?

Gross Pay – Taxes – Deductions = Net Income. That’s your take-home pay. For budgeting, always use net income because that’s the actual money you have. If you’ve got multiple jobs or side hustles, add them all together.

How to find budgeted income?

Look at what you expect to bring in for the month. If you get two paychecks of $1,500 each, your budgeted income is $3,000. If your pay changes every month, average out the last few months and use that number. Always go with the lower end if it bounces around – better safe than sorry.

How to calculate income?

For salary, divide your yearly pay by 12. For hourly, multiply your hourly rate by hours worked per week, then multiply by 4.33. So $15 an hour, 40 hours a week is $15 × 40 = $600 per week, then $600 × 4.33 = $2,598 per month before taxes. Check your actual paychecks to see what you really bring home after taxes.

How do we calculate total income?

Add up everything – main job, side hustles, freelance work, rental income, whatever puts money in your pocket. Main job $3,000 + freelancing $500 + parking space rental $200 = $3,700 total. Use after-tax numbers so you know what you actually have.

How to calculate expenses and income?

Income is everything you bring in. For expenses, track what you spend for a month – go through bank statements and credit card statements. Write it all down, add it up. Then do Income – Expenses = What’s Left. Positive number means you’re good. Negative means you’re overspending.

Is income calculated after expenses?

No. Income comes first – it’s what you earn. Expenses are what you spend. The formula is Income – Expenses = Profit or Loss. If you make $4,000 and spend $3,500, you’ve got $500 left. If you make $3,000 but spend $3,500, you’re $500 in the hole.

What is the formula for calculating income method?

For personal budgeting: Wages + Side Income + Any Other Money Coming In = Total Income. Use your take-home pay, not gross pay, because that’s what you actually have to spend.

What are the 5 steps to calculate your budget?

Step 1: Figure out your monthly income. Step 2: List all debts and minimum payments. Step 3: Write down fixed expenses like rent and utilities. Step 4: Track variable expenses like fun money and subscriptions. Step 5: Add it all up and make sure expenses are less than income.

What are the 7 steps in good budgeting?

Step 1: List monthly income. Step 2: Write down debt payments. Step 3: Add fixed expenses. Step 4: Include variable expenses like groceries and gas. Step 5: Add fun money. Step 6: Include savings. Step 7: Create a buffer for unexpected stuff. Then add it all up and make sure it equals your income.

What is the best formula for budgeting?

Income – Expenses = Zero. That’s zero-based budgeting. Every dollar gets a job. Some people use 50/30/20 – 50% needs, 30% wants, 20% savings. But the best formula is whatever you’ll actually stick to.

How is income calculated in accounting?

Revenue – Expenses = Net Income. That’s how businesses do it. They take all money coming in, subtract all costs and expenses, and what’s left is profit. For budgeted income, they estimate future sales and costs to predict what they’ll make.

How to make an income budget?

Write down how much you expect to bring in. Regular paycheck? Write that down. Irregular income? Average the last 6-12 months and use the lower end. List everything – main job, side work, whatever. Add it up. That’s your budgeted income.

What is the income budget line?

It’s the top line of your budget – the total money you have to work with. If it says $4,000, everything else has to fit under that. All your expenses, savings, debt payments – they all come out of that top line number.