Table of Contents

ToggleUnderstanding Debt Review Removal

Simple explanation How Much Does It Cost to Remove Debt Review is a legal process mostly used in South Africa.

Someone cannot afford to pay all their loans, they are put under Debt Review. After all debts are fully paid, the person must remove Debt Review to:

-

Apply for new loans

-

Use credit cards again

-

Fix their credit profile

This removal does not happen automatically.

You must pay a removal fee.

How much does it cost?

-

Simple cases: about R1,000 – R3,000

-

Normal cases: about R3,000 – R7,000

-

Complex / court cases: R10,000 or more

What affects the cost?

-

Are all debts fully paid?

-

Do you have paid-up letters?

-

Is a court or lawyer involved?

Important things to know

-

Debt Review removal is not free

-

You cannot remove it by yourself

-

It must be done by a registered debt counsellor or through court

-

“Free Debt Review removal” offers are usually scams

IN short: Removing Debt Review means clearing your legal debt status, and it costs money.

Common Reasons People Want to Exit Debt Review

-

They Want to Apply for New Credit

-

Car loan, home loan, or business loan

-

New credit not allowed under Debt Review

-

-

Income Has Improved

-

Better job, promotion, or extra income

-

People Feeling now manage a normal repayment

-

-

Debt Review Feels Too Restrictive

-

Credit cards frozen

-

No overdraft

-

No store accounts

-

People want their financial freedom back.

-

-

They Want to Improve Their Credit Profile

-

ON a Debt Review status credit report does a negative impact

-

Exit ke baad credit score rebuild hota hai

-

-

They Found a Better Debt Solution

-

Debt consolidation

-

Refinancing with a bank

-

Employer-assisted repayment plans

-

-

Monthly Payment Is Still Too High

-

Sometime despite a debt review the payment is not affordable.

-

People finding the alternative solutions.

-

-

They Plan to Start a Business

-

Business loan or trade credit should be

-

This is not Possible in debt review

-

-

They Want to Buy or Upgrade a Car / Home

-

This is not possible for financing.

-

That why people went to a exit.

-

-

They Were Placed Under Debt Review by Mistake

-

wrong assessment

-

Incomplete information

-

in this case people want to a quick exit.

-

-

Mental & Emotional Stress

-

There are Long-term restrictions frustrating.

-

People went back the peace of mind or control.

In Short: People want to exit Debt Review to regain financial freedom, access credit, and improve their financial life. Many people want to exit Debt Review because they plan to apply for business funding, such as SBA loans, which require good credit standing and no debt restrictions.

The Legal Way to Get Out of Debt Review

Here’s the truth, and it’s not always what people want to hear: settle your debts. That’s the legal way out. For many people, that’s tough medicine to swallow. But if you’ve signed up and have a granted court order, there’s no other legitimate exit. You have to settle your debts.

This isn’t just advice, it’s the law. The debt review process exists to protect consumers who got buried under debt. The only legitimate exit is through fulfilling what you owe. I know it seems frustrating, especially if your money situation has gotten better. But it’s the only path that protects both you and your credit record down the line.

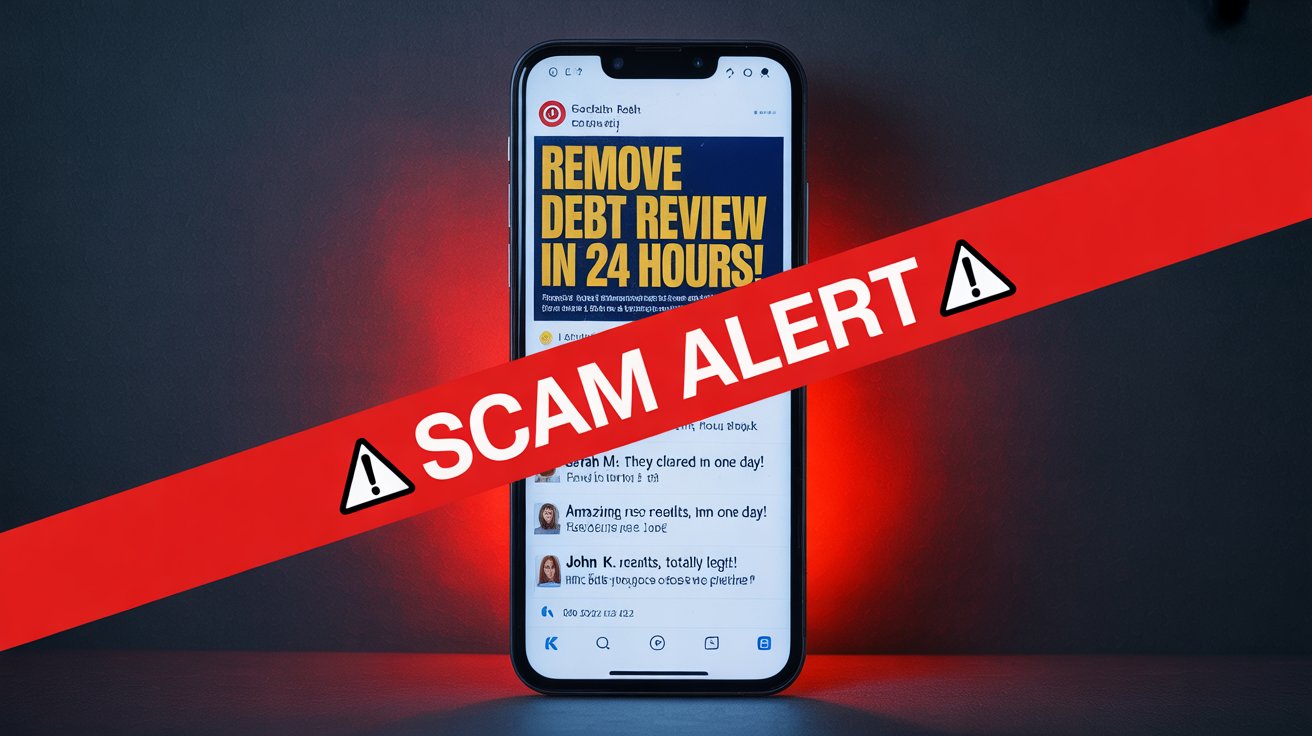

Beware of Debt Review Removal Scams

Here’s what really worries me: scammers are everywhere, trying to get you to pay R6,000, R10,000, even R12,000, claiming they’ll lift your debt review just like that. So many people have handed over their hard-earned money to these guys, and then suddenly, the person won’t answer their calls anymore. You have to be extremely careful about who you trust with this.

These scammers know people are desperate for quick solutions. They make big promises about removing your debt review overnight or guaranteeing you’ll get loans approved. But nobody can legally remove you from debt review except through the proper channels. The money you waste on these fraudsters could have gone toward settling actual debts, which would have actually moved you closer to real freedom.

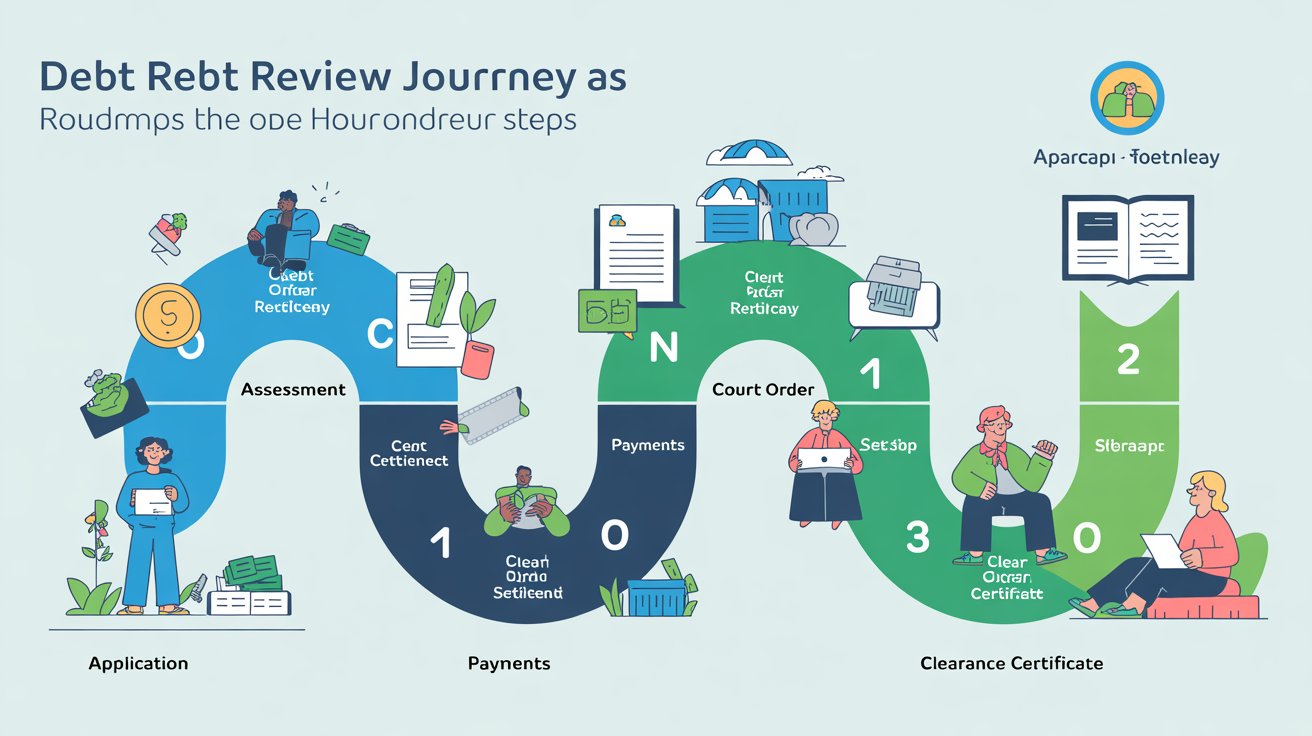

The Clearance Certificate Process

Once your debts are settled, a debt counselor issues what’s called a clearance certificate. This document officially proves you’ve completed the debt review process successfully. Meerkat makes this journey simple and painless. Head to the website, search for Meerkat clearance, and you’ll find a straightforward digital process where they assess what you need based on your specific situation.

The clearance certificate is everything. It’s the document that updates your credit status with all the credit bureaus. Without it, you’ll stay flagged as being under debt review, even if you’ve paid off every single debt. That’s why working with a legitimate debt counselor who can issue this certificate matters so much.

What If You’re Still Making Payments?

If you’re currently in debt review and making your payments but now want access to credit, chances are it’s too early. You’re probably not ready yet. What you can consider is accelerating the process, paying more each month or asking to settle specific debts outright, which shortens how long you’re in the system.

Many people get impatient with the debt review process, especially after making consistent payments for a year or more. But trying to exit early without completing your obligations can backfire badly. Instead of looking for shortcuts, think about ways to speed things up legitimately. Even an extra R500 or R1,000 per month can cut down the time you spend under debt review significantly.

But honestly, the best way out is to be completely debt-free. Remember why you started this journey in the first place, you were drowning in debt. Finishing the process properly means you walk away with a clean slate and some valuable financial lessons under your belt.

Who Is Eligible to Exit Debt Review?

Not everyone can just walk away from debt review whenever they feel like it. To be eligible for exit, you have to have settled your debts. There’s no negotiating around this, and it applies to everyone, no matter how long they’ve been in the process or what their bank account looks like now.

Court Order Rescission: The Truth

There was a time when people thought they could go to court and a judge might say you can exit debt review without settling everything. Some people hoped for a legal loophole that would let them escape their obligations. But there have been several court decisions that shut that door completely. The courts have made it crystal clear that the debt review process must be completed as designed.

This means paying expensive legal fees to try getting a court order rescinded is throwing money away. The legal framework around debt review is solid, and judges are bound by these laws. Your money would do more good going toward settling your actual debts rather than chasing legal miracles that simply don’t exist.

Understanding Debt Review Status Flags

The debt review process uses different status flags to show where someone is in the journey. Knowing these flags helps you understand exactly where you stand.

What the Different Flags Mean

Some people have an “A” status. This just means they’ve applied for debt review. They’re not actually flagged yet, but they think they’re stuck in debt review because they can’t get loans. The truth is, those loan rejections are probably happening for other reasons that have nothing to do with the “A” flag. This confusion is really common, people assume they’re trapped in debt review when they’re actually facing different credit problems.

If you have a C, D3, or D4 flag, you’re at different stages of the actual process. At Meerkat, we look at your situation and give you advice based on your current stage. Each flag represents a specific milestone, and figuring out which one applies to you is the first step toward fixing things.

A D4 flag means your court order has been granted. If you’re at this stage, you have to work through and settle those debts. Once they’re settled, get the settlement letters, and we can issue your clearance certificate. The D4 status means you’re legally bound by a court order, which is the most serious level of debt review.

Making Smart Financial Decisions

Let me be blunt: don’t give 10,000 Rs to some guy on Facebook who promises to settle your debt review. Take that 10,000 Rs and get settlement letters for one or two of your actual debts instead. This approach actually works and moves you closer to your goal.

Think about it practically. R10,000 could completely wipe out a small debt or make a serious dent in a bigger one. Each debt you settle brings you one step closer to that clearance certificate. Money spent on legitimate debt settlement is an investment in your financial freedom. Money handed to scammers is just gone forever.

This matters because social media is still flooded with people claiming they can get court orders rescinded. They can’t. Don’t let flashy ads and fake promises mess up your progress.

How Long Does the Removal Process Take?

Knowing the timeline for debt review removal helps you set realistic expectations and keeps you from getting frustrated during the process.

The Assessment and Transfer Process

When someone comes to Meerkat for flag removal, the assessment takes about a week. We often have to transfer the client from another debt counselor to Meerkat. This involves collecting all your documents, looking at your payment history, and making sure everything checks out.

Once everything is sorted, we issue the clearance certificate within about a week. But that’s not where it ends. Clients need to wait roughly a month for all credit bureaus and banks to update their systems before they can apply for loans.

This waiting period drives people crazy, but there’s no way around it. The credit bureaus need time to process everything and update your credit profile across all their systems. If you try applying for credit right after getting your clearance certificate, you’ll probably get rejected just because the systems haven’t caught up yet.

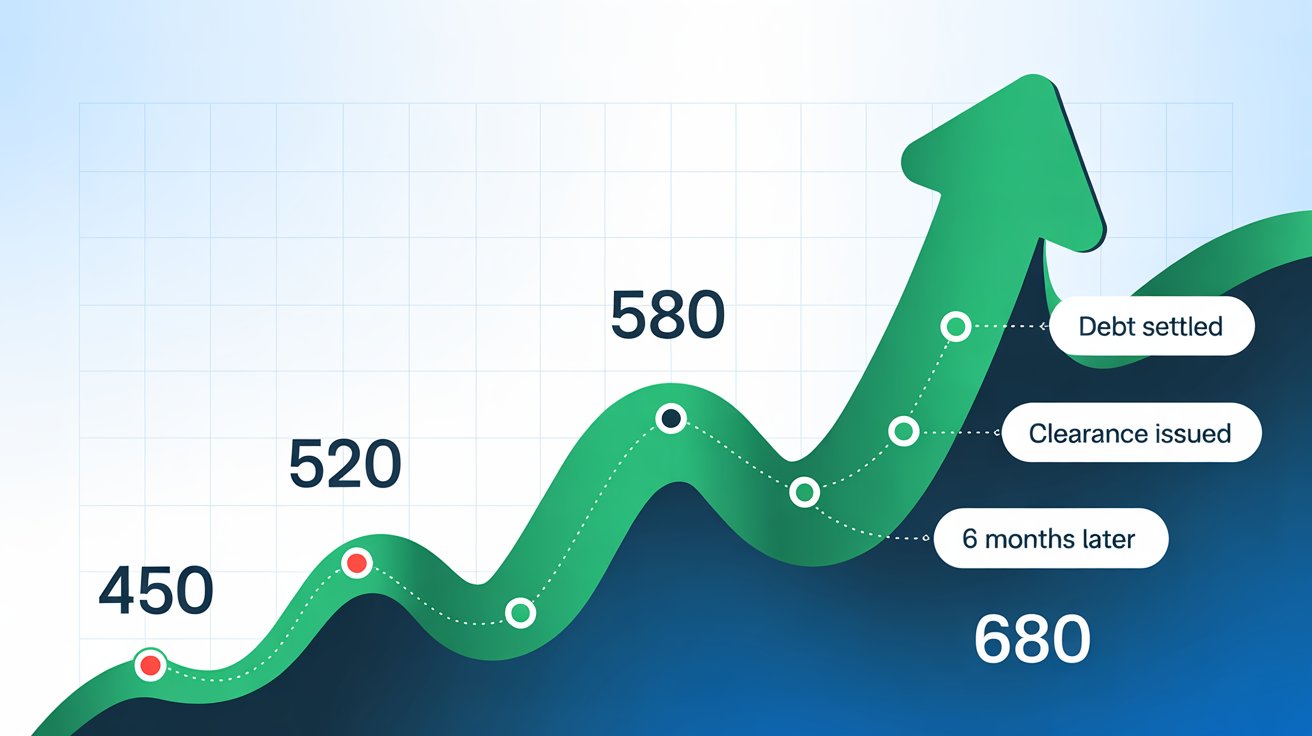

Credit Score and Loan Approval After Removal

Getting a clearance certificate is huge, but you need to understand what it actually guarantees and what it doesn’t.

Managing Your Expectations

Just because we’ve issued a clearance certificate doesn’t mean you’ll automatically get approved for loans. People come back to us all the time saying they didn’t get a loan. Sometimes it’s affordability issues, you still might not qualify for another loan based on your income. Other times it’s your credit score.

This is one of the hardest truths for people to swallow. They’ve worked their tails off to pay debts, got their clearance certificate, and then feel blindsided when they’re still denied credit. But here’s the thing: debt review removal only clears your debt review flag. It doesn’t erase your credit history or magically improve your credit score.

Understanding Prescribed Debts and Credit Scores

Some people think that if debts prescribe, they can get cleared and automatically qualify for a loan. Banks don’t forget unpaid debts though. You don’t have one universal credit score either, different banks keep their own scoring systems.

If you let a loan prescribe with Absa, they’re not going to look kindly at your next application. They remember the unsettled debt on their books. CapiTech might not have that same information, so you could have better luck there. But there are so many factors that affect loan approval. At Meerkat, we help people understand these factors when we can.

Banks share information, but they also keep their own internal records. A prescribed debt might disappear from your credit report after three years, but the bank where that debt started will remember it forever. That’s why settling debts properly, instead of waiting for them to prescribe, is always the smarter long-term move.

Costs Involved in Debt Review Removal

Let’s talk actual numbers, the legitimate costs you can expect when removing debt review through proper channels.

Standard Clearance Certificate Fees

When a client transfers from another debt counselor and needs a clearance certificate, we charge 1,150 Rs for a simple, single-applicant process. If you pay cash, there’s an extra 50 Rs to cover what the bank charges for handling cash. Joint applications cost a bit more, about one and a half times the single rate, not double.

This pricing is upfront and reasonable, especially compared to the thousands that scammers charge for services they never actually deliver. When you work with a registered debt counselor, you’re paying for a real service that will legally help you exit debt review.

If You Still Have Payments Remaining

Some consumers still have eight or nine months of payments left on their debt plan when they come to us. We’ll manage those debts as Meerkat, and the clearance certificate becomes free at the end, provided you’ve been with Meerkat for enough time.

This makes sense for people who are almost done with their debt review but want to make sure everything gets handled properly. Instead of struggling with a disappeared debt counselor or someone who won’t respond, transferring to Meerkat means you’ll actually get your clearance certificate when you’re supposed to.

Previous Debt Counselor Fees

Sometimes people signed up with a debt counselor but never made payments. That previous debt counselor still did work though, negotiating with banks and putting together proposals, and they deserve to get paid for it. When we request a file from a previous debt counselor, sometimes they refuse because the client didn’t pay for the work that got done.

In cases like these, we have to tell the client they need to pay the previous debt counselor before we can move forward with the transfer. This is something to keep in mind depending on how things were left when you stopped working with your previous debt counselor. It might feel like an extra expense, but it’s actually money you already owed for services that were provided. There’s no getting around this payment if you want to progress.

The Role of Lawyers in Debt Review Removal

Understanding who does what in the debt review process helps you avoid paying for services you don’t actually need.

How Attorneys Support the Process

The legal profession has an active role in debt counseling. As debt counselors, we handle the numbers and do the negotiations with banks. But we depend on our legal colleagues to get the court order granted. An attorney presents the plan to the magistrate, who then approves it and turns it into a court order.

This court order process matters because it gives legal certainty to the customer. This is especially important if they have a home or car, because the court order protects those assets. The court order legally stops creditors from repossessing your stuff while you’re making payments under the debt review plan.

Avoiding Legal Scams

There are lawyers operating in the shadier corners of the industry who claim they can remove the debt review process for a fee. From what we’ve seen, customers pay these fees and don’t get the resolution they’re hoping for. We stick to the proper process: a debt counselor is the right professional to issue a clearance certificate after debts are settled.

Remember, legitimate lawyers have a specific job in getting your court order granted. They don’t have special powers to remove you from debt review without you settling your debts. Any lawyer promising otherwise is either confused or lying.

We have a simple online process you can access on our website at meerkat.co.za , just search for “clearance.” You can do the whole thing digitally, and we issue a clearance certificate within about four to five weeks.

Why Choose Meerkat for Debt Review Removal

With so many options and so much wrong information floating around, why should you trust Meerkat?

We Do the Job Properly

The simple answer is that we do the job right. Social media is packed with ads from people claiming “we’ll remove you from debt review, we guarantee you a loan, blacklisted or not.” But it’s important to actually understand what removal from the process means.

Meerkat doesn’t make fake promises or guarantee outcomes that are legally impossible. We focus on guiding you through the legitimate process, giving you transparent information, and actually delivering the clearance certificate once you’ve met the requirements.

Understanding Form 17W vs. Clearance Certificate

Some consumers think that getting a Form 17W means they’re removed. That’s wrong. To be removed from debt review, you need a clearance certificate, which a debt counselor issues once debts are settled.

This confusion has sent many people down the wrong path. A Form 17W gets used when a debt counselor rejects your application for debt review or when you voluntarily pull out before the process starts. It’s not the same as completing debt review successfully. Only a clearance certificate (Form 19) officially removes you from debt review after you’ve settled your debts.

Helping Consumers in Difficult Situations

We often help consumers whose debt counselors have vanished or who aren’t happy with their current debt counselor. After they transfer to Meerkat, we do an assessment, figure out what’s needed, and help the customer get to where they’re trying to go.

The debt counseling industry has seen many people come and go, leaving consumers stranded without support. If this is your situation, you’re not alone, and there is a way forward. Transferring to a stable, reputable debt counselor means you can actually finish the process.

The Surprising Truth About Debt Review Flags

Here’s something interesting we’ve discovered: 20% of people who come to us saying they’re flagged and want a loan actually aren’t flagged at all. At first, this surprised us. But it shows that these people got refused loans and just assumed it was because of a debt review flag when they were actually declined for completely different reasons.

This number highlights an important truth: debt review isn’t always why you’re getting denied credit. Poor affordability, a low credit score, not enough income, too many credit checks, or other factors might be the real problem. Before spending money trying to remove a debt review flag, make sure you actually have one.

The New Creditworthy Product

Understanding why you’re getting denied credit is just as important as removing debt review flags.

Understanding Your Credit Position

We’re bringing out a product to help customers understand why they’ve been declined for a loan. We’re calling it the Creditworthy product. It pulls together all the information banks look at and gives you insight into why you got declined.

This tool fills a gap that’s frustrated consumers for years. Banks decline applications but almost never give detailed explanations. The Creditworthy product gives you a full picture of how lenders see you, which gives you the power to take the right steps to improve your situation.

More importantly, if you want to buy a house, it shows how likely you are to get approved and gives you tips on how to improve your chances. At Meerkat, it’s not just about answering the immediate question, “please give me a clearance certificate.” It’s about helping you secure a loan and move forward with your life.

Final Thoughts: Your Path Forward

The journey through debt review and out the other side isn’t easy, but it’s absolutely possible when you follow the right process. The cost of removing debt review legally through Meerkat is 1,150 Rs for a standard clearance certificate, way less than what scammers charge for empty promises.

Keep these key points in mind: settle your debts, work with a registered debt counselor, be patient with the process, and don’t fall for scams promising quick fixes. Your financial freedom is worth doing things the right way, even if it takes longer than you hoped.

If you’re ready to take the next step, visit meerkat.co.za and search for “clearance” to start your assessment. The path to financial freedom starts with one decision: choosing to do things properly.

Frequently Asked Questions About Debt Review Removal

How much does it cost to remove a debt review?

The real cost through a registered debt counselor like Meerkat is 1,150 Rs for a single-applicant clearance certificate. Cash payments need an extra 50 Rs for bank fees. Joint applications cost about one and a half times this amount. Anyone charging R6,000 or R10,000 is probably a scammer.

Can I Remove the debt review myself?

No. Only a registered debt counselor can issue a clearance certificate. You can settle your debts yourself, but you still need a debt counselor to officially remove the flag from your credit profile.

Can I get a loan after being removed from debt review?

Not automatically. Banks still check your affordability, credit score, and income. Wait about a month after getting your clearance certificate for systems to update. The certificate removes the flag, but doesn’t fix your credit history or score.

How long does an NCR take to remove a debt review?

The NCR doesn’t directly remove it, your debt counselor does. Once Meerkat issues your clearance certificate, it takes about a week to process. Then wait roughly a month for credit bureaus and banks to update. Total time is about four to five weeks after debts are settled.

Is debt review removal permanent?

Yes. Once properly removed with a clearance certificate, you won’t get flagged again unless you enter debt review again later. Your credit history stays on record though, only the debt review flag gets removed.

How do I remove the red flag on my name?

Settle all your debts and get a clearance certificate from a registered debt counselor. If it’s not a debt review flag, check your credit report first to see what’s actually causing the problem. Many people assume they have a debt review flag when it’s something else.

Can I raise my credit score 100 points in 30 days?

Very unlikely. Credit scores build over time through consistent good behavior. You might see small improvements quickly by paying off credit card balances or fixing errors, but big jumps in 30 days rarely happen. Real credit repair takes months.

How do you unblacklist yourself?

Settle outstanding debts, pay off judgments, and wait for negative information to fall off your report. Paid accounts show for one year, defaults for two years, judgments for five years. There’s no quick fix. Anyone promising overnight removal is lying.

Can red flags be fixed?

Yes, but it depends what’s causing them. Wrong information can be disputed with the credit bureau. Legitimate debts need to be settled. Debt review needs a clearance certificate. Judgments need to be settled and legally cleared. Figure out what the red flag is first.

How to get a 700 credit score in 30 days?

Not realistic for most people. If you’re already close to 700, you might get there by paying down credit card balances or fixing errors. Starting much lower means months of good behavior, paying on time, keeping balances low, not applying for new credit.

Is it better to settle debt or pay in full?

Paying in full is always better for your credit. “Settled” looks worse to lenders than “paid in full.” But if you can’t pay in full, settling is still better than leaving it unpaid. For debt review, you must settle all debts completely to get your clearance certificate.

Is it true that after 7 years your credit is clear?

Not quite. In South Africa, paid accounts show for one year, defaults for two years, judgments for five years. Debt prescription is three years, creditors can’t legally force payment after that, but it doesn’t disappear from your record. Banks also keep their own internal records forever.