Private banks use the cost-to-income ratio to measure how efficiently they operate, basically, how much they spend to earn their revenue. The industry average is around 69-73%. A lower ratio means better efficiency, higher profits, and potentially better returns or services for you as a client. So it indirectly affects your wealth strategy

In this article, I’m going to talk about the difference between private banking and wealth management and why you need both. I’ll cover three things specifically: the difference between private banking and wealth management, your relationship with your local private banker, and the big one at the end, how do you become a bank? Can’t wait to teach you that.

Table of Contents

ToggleUnderstanding Private Banking and Wealth Management

Let’s start with the definition of private banking and wealth management.

What is Private Banking?

A lot of you out there might think, “Well, this isn’t for me because I’m not even close.” Stay here right now because it could be you, and I want to motivate you to make it you. Private banking is a section within most banks for high net worth individuals .

That’s simple. You say, “Well, what’s high net worth?” I can tell you you’re going to have to be a millionaire to walk through the doors. But that’s not going to take very long. I’m a millionaire-maker. I have a three to five-year plan. I have people right now, even during the Covid period with the volatility of the market, becoming millionaires in 18 months. This is not difficult. Private banking is when you start banking on the other side of the bank.

What is Wealth Management?

Now, wealth management firms are typically separate entities. There are a lot of firms in the country, some really good ones, some really crappy ones and they will help manage your money and your wealth as you accumulate it. Typically, beginning firms will take you at a quarter million or half million, and then they’ll grow with you as you grow your wealth into 1, 2, 5, 10 million and beyond. So, there is a difference, and they do coexist. You’re going to have both.

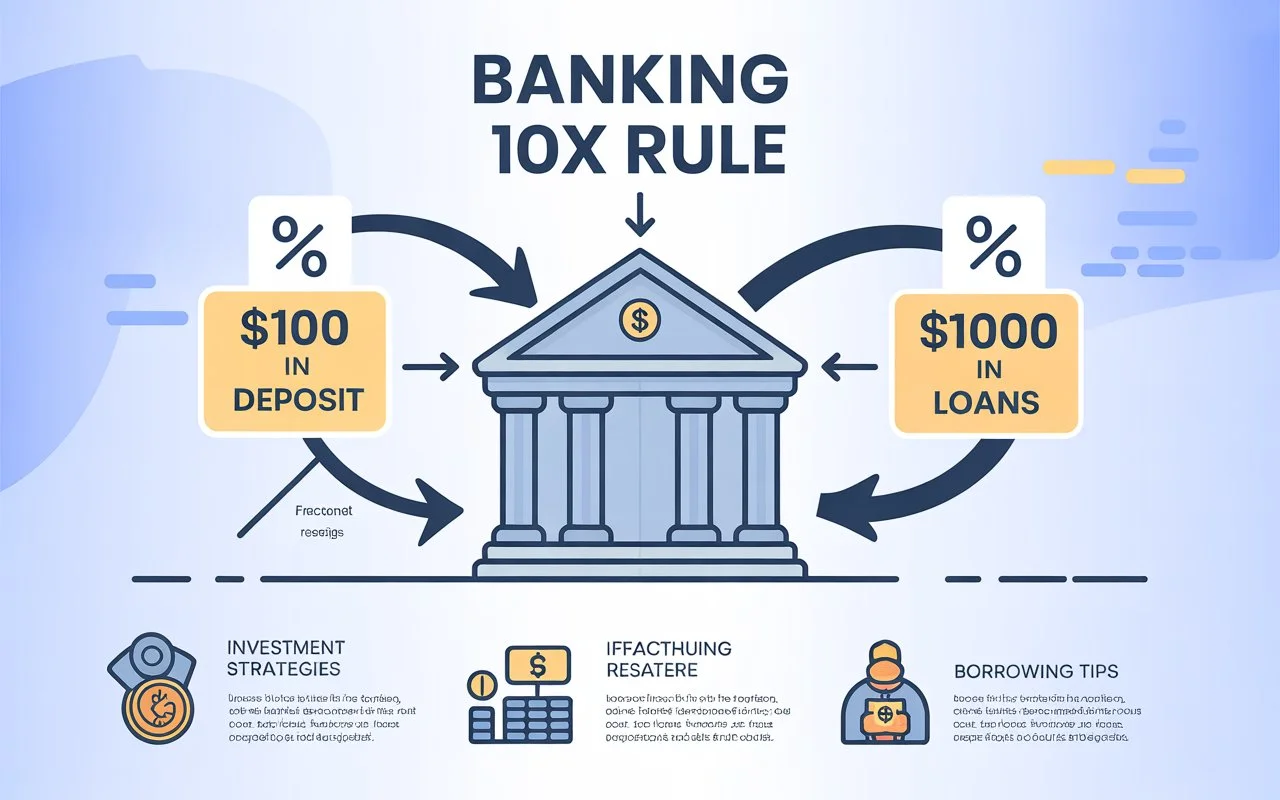

The Banking 10x Rule Explained

Now, let’s just talk about banking before we go on. Banking has a 10x rule. What happens when you put a deposit in the bank? For those of you who are beginners and staying tuned, thank you.

Your First Financial Milestones

My first goal for you is to help you make $100,000. I love the first hundred, it’s the most difficult. Why? Because we’re employee-trained, not entrepreneurially trained. You can’t take employee skills that you might have learned in college and become an amazing entrepreneur.

You’re going to need mentoring and help from someone like me to show you how to make that first $100 quickly. Believe me, I promise, I actually have a guarantee I’ll do it in less than a year. This way, we can get over that learning curve of becoming a great entrepreneur.

The next goal is that you become accredited. That’s a $200,000 per year goal, and for two years in a row, if you make $200,000 or more, or as a couple $350 or more, you’re now considered accredited. With the accredited status, you now have access to invest in all sorts of alternatives that you normally couldn’t invest in, PPMs, prospectuses, private businesses, a lot of real estate deals. Phenomenal. So our first goal is $100K, our next goal is accredited, our next goal is millionaire and then once you hit a million, you’re off to the races.

How Banks Leverage Your Deposits

Now, back to banking. Picking that first bank where you’re going to do this growth is important. I would encourage you to choose one that has a private section of the bank so you can move there sooner rather than later.

So, here’s how banks work. If you put $100,000 in the bank’s deposits per year, you give them what’s called the 10x rule. They get to reach up to the central banks and get a million. So, they get 10 times your deposits.

Building a Relationship with Your Private Banker

Now let’s go to the other side. Why private banking works and why it’s so important, and why your relationship is personally so important. You put a million in, and you’ve now given that bank the opportunity to get $10 million. You say, what do they do with it? They give out loans. They give individuals loans. They give companies loans. So they make money on what’s called the spread.

You’re not getting paid for your deposits. I mean, there are people who actually motivate you with a coffee pot or some little trinket to move from one bank to the other. They’re motivating you to put in deposits because with their collective deposits in a bank, they get 10x that, which is their loan ability. So then they can put out loans.

Knowing that, way back in the day, I’ll tell you a quick little story about how I got a laundromat on my terms.

My 2% Loan Success Story

I went into the bank, and knowing this, I actually put a spreadsheet together of the years and years that I’d been doing deposits. I was on the private side, so I knew my guy really well. I walked in with this little spreadsheet of all the money that I’d put into his bank on deposits, millions of dollars. I said, “So I know that I have put millions in and you got this.

You got 10 times that amount to then borrow out to customers at 7-10%. I mean, people with bad credit at 12%. You made all that money. Well, I gave you the benefit of that. So, knowing that, I’d like a free loan.” We had a fun little laugh. He said, “Aren’t you cute?” I said, “Well, I am.”

But I know you have to go to committee, banks go to committee at least once a week, if not more than that. They’ll go to the committee and talk about the different folks applying for loans. So, of course, they brought me up and brought my little presentation that I gave them. They came back, and I got a two percent loan. Now, I got $200,000 for two percent.

I had $200,000 in the bank already invested in other things. So obviously, the first question is: why don’t you use your own money? Because that’s invested at more than two percent. So if that’s invested at, say, 12%, why would I want to take that out to use my own money when I can use yours? You’ve used mine for the whole time.

So I have a lot to teach you. When you get to that point where you need a banking conversation, I want you to reach out and say, “Loral, coach me. Give me a script on how to help me get my two percent loan.” I’ll help you put that presentation together and have the conversation. I bought a new laundromat for $200 grand and got it for two percent, which is like free money.

The Importance of Face-to-Face Banking

When you really understand the system, it’s to your advantage. Because right now, a lot of people don’t even know that basic rule of private banking, of just banking in general, and how you can use it.

You really do need a relationship. The challenge in today’s day and age, with all this digital access going on, is that you can pretty much do a lot of your transactions digitally, and there’s no face behind the bank. I cannot encourage you enough to walk through those doors and get to know the human who’s actually the brain, the decision-maker behind your requests.

So it’s really important that you get to know, ideally, if you’re at small enough banks, the bank president or the lending officers. Get to know them. And you know what? Even if you don’t qualify for private banking, I’ll give you a little homework: walk through the doors and introduce yourself. Say, “I’ll see you soon,” and then make it happen. That’s my favorite activity because it puts you on the line for a commitment that I want you to keep, and I know I can help you with it.

Creating Your Wealth Management Strategy

Now, let’s go to the other side of wealth management. Wealth management is the collective. You can give your money to a wealth management firm, there are a lot of good ones and, like I said, there are bad ones, and what I’m going to teach you is to do some of your own wealth management to understand your money rules. To understand the integration of wealth.

The reason I exist and built the company the way that I did is because I’m not a financial planner. I’m not licensed. I really curated a whole team of experts, from alternative financial planners to tax strategists, simple CPAs, bookkeepers, real estate experts, M&A experts, insurance, trusts, corporate structure, you name it. So, a huge team of experts that when you come in, you get access to them. The benefit is we all talk to each other.

Why Your Wealth Team Needs to Communicate

How many people on your wealth team talk to each other, including your wealth management team? Because your wealth management team might have insurance, it might have a trust, typically it doesn’t. It’s really just management of your family office and these assets. But those people have to talk to the people that handle insurance, your entities, your trust, your tax advisor. All these people have to have one conversation, not five or six, and then there you are in the middle trying to manage it all.

So my goal is to be your educator, to be your advocate, to stand in the middle of all those people and help put together a proper wealth management plan with your goals, your family’s goals, and your family’s legacy. And then you’ll be using private banking as part of that strategy.

How to Become Your Own Bank

So, the last and most fun part is: how to be your own bank? When you acquire enough money, you can be a bank in several ways.

Becoming a Hard Money Lender

You can be your own bank by being a lender, and again, you would want to use the private banking structure because that’s what’s going to hold your money. You can actually work with escrow accounts to help manage and control all that. You can lend your money to different real estate folks. I know people who do it just in private aviation, where they’re helping people buy planes. Buy businesses, there are many opportunities.

Using Life Insurance as Your Personal Bank

Another way to be your own bank is through life insurance. There are very specific policies. In fact, there are seven that our insurance expert uses, and that’ll come in a future article. How to be your own bank and how to put money into insurance, but then you get the capacity to borrow it back out. So essentially, it’s your money being leveraged back out to go buy real estate. You can buy businesses. You can invest in your own business. But essentially, you’re your own bank and your own cycle of cash. It’s phenomenal.

So, there are lots of ways to be your own bank. Those are my two favorites. My favorite is accumulating enough money and being the lender. You could create your own fund. You could create your own private equity firm, that’s for a later conversation. But I just want to invite you to think about this, even on a small scale. Say that you accumulate $100,000-$200,000, be very cautious and aware of those loans, especially with your family and friends.

Sometimes those don’t get paid back. I’m not a fan of those at all. But I am a fan of working with a private banker, working with other people who have been a bank, and learning how to do convertible debt lending and how to become a bank to help other people fund their dreams. You get first position. You’ll get the asset back if it doesn’t work. Much stronger position than being an equity partner. Lots to teach you, lots more.

Take Action Today

Before we leave, though, if this is interesting to you, even if you’re a beginner and say, “Oh, it doesn’t apply to me yet”, make it apply to you. Be that person who’s going to set a big goal and say, “I’m going to have this one day in my life.” So fill out an application. There’s a link in the notes below. Fill out the application thoroughly.

The more I know about you, the more we can help you. Just say, “Hey, I want a meeting. I want one-on-one time with Loral’s senior team. I want to talk about this financial infrastructure, private banking, wealth management, because I’m going to be there too.” So, fill out the application, send it in to us, and I’ll talk to you on the other side.

Frequently Asked Questions

Q:What is a good cost-to-income ratio for a bank?

A good cost-to-income ratio for a bank sits between 40% and 60%. So for every dollar the bank earns, it’s spending 40 to 60 cents on running the business. Lower ratios mean the bank is running efficiently and making solid profits. Higher ratios? That means expenses are chewing up too much of the revenue.

Q:What key financial ratios would be important in evaluating a bank’s strategy?

When you’re evaluating a bank’s strategy, look at these key ratios:

- Cost-to-Income Ratio – shows how efficiently the bank operates.

- Net Interest Margin (NIM) – tells you how much profit comes from lending.

- Return on Assets (ROA) and Return on Equity (ROE) – measure profitability.

- Loan-to-Deposit Ratio (LDR) – checks liquidity management.

- Capital Adequacy Ratio (CAR) – gauges financial stability and risk.

Together, these give you the full picture of how well the bank manages growth, profits, and risk.

Q:Why do rich people use private banks?

Rich people use private banks because they get personalized service—wealth management, tax planning, exclusive investment deals, and a level of privacy you don’t get at regular banks. They also get tailored advice and priority treatment that’s just not available to everyday banking clients.

Q:What does the cost-to-income ratio indicate?

The cost-to-income ratio shows how efficiently a bank runs by comparing what it spends to what it earns. A lower ratio means the bank is keeping costs under control and making strong profits. A higher ratio? That’s a red flag for inefficiency or bloated operating costs.

Q:Is a 70% debt-to-equity ratio good?

A 70% debt-to-equity ratio is moderate and generally acceptable. It means for every dollar of equity, there’s 70 cents of debt. Whether it’s “good” depends on the industry. Capital-heavy businesses can handle higher ratios, but service companies should aim lower.

Q:What’s the average ratio by industry?

Financial ratios vary a lot depending on the industry:

- Banking: Cost-to-income ratio 40–60%

- Manufacturing: Debt-to-equity around 1.0–1.5

- Technology: Debt-to-equity below 0.5

- Retail: Net profit margins 2–5%

Comparing a company’s ratios to its industry average tells you if it’s ahead of the pack or falling behind.

Q:Why is it important to compare financial ratios with industry averages?

Comparing ratios with industry averages gives you context. It shows whether a business is running efficiently or struggling compared to competitors. For example, a 70% debt-to-equity ratio might be fine for a bank but risky for a tech company. These comparisons help investors and analysts make smarter decisions.

Q:What is a good P/B ratio for banks?

A Price-to-Book (P/B) ratio between 1.0 and 2.0 is solid for banks. Below 1.0? The bank might be undervalued. Above 2.0? Could be overvalued or just riding high investor confidence. The ideal range really depends on the bank’s profits, risk, and market conditions.

Q:Is a 2% net profit margin good?

A 2% net profit margin is on the low side but acceptable in industries with high costs and volume-based sales—think retail or banking. For banks, that margin can still mean healthy profits depending on total assets and loan performance. Generally, higher is better, but “good” is relative to the industry.