So you need funding for your business. You’ve probably heard about SBA loans a bunch of times. Maybe your accountant mentioned them. Maybe another business owner told you about theirs. Either way, you’re here because you want to know what the deal is with these loans.

I’m gonna break down everything you need to know. What these loans actually are, the good parts and the crappy parts, whether you can even qualify, and where you go to get one. And here’s something important what happens to SBA loan if business closes down. Yeah, we need to talk about that because it’s not something most people think about until it’s too late. But it matters. A lot. Your personal stuff could be on the line if things go south with your business.

Look, I’ve worked with tons of small business owners. I’ve seen people get approved. I’ve seen people get rejected. I’ve seen people get into trouble because they didn’t understand what they were signing up for. So I’m gonna give you the real deal here. No fluff. No corporate speak. Just straight talk.

Table of Contents

ToggleWhat is an SBA Loan? Understanding the Basics

Alright, first question. What even is an SBA loan?

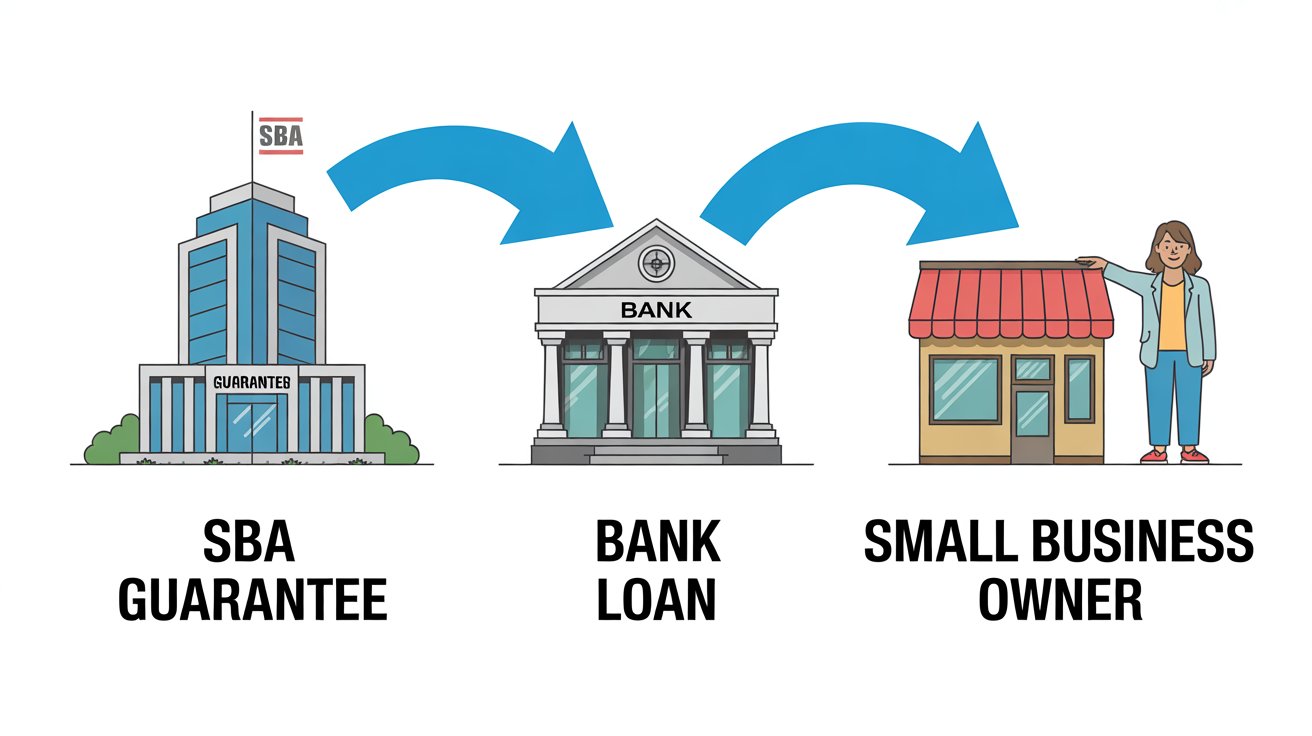

SBA stands for Small Business Administration. It’s a government agency. Their whole job is helping small businesses. Sounds good, right? But here’s where everyone gets confused.

The SBA doesn’t give you money.

I know. Weird, right? You’d think the Small Business Administration would, you know, actually hand out loans. But they don’t work that way.

How SBA Loan Guarantees Work: The Bank’s Safety Net

Let me paint you a picture of how this actually works.

You walk into Chase Bank. Or Wells Fargo. Or whatever bank. You ask for a business loan. Maybe you need $100,000 to expand your restaurant. Or buy new equipment for your shop. Whatever.

The banker looks at your application. Looks at your credit. Looks at your business financials. And they’re thinking one thing: “Will this person pay us back?”

If they think the answer is no, they reject you. Simple as that. Banks aren’t in the business of losing money. If they give you $100,000 and you don’t pay it back, that’s $100,000 down the drain for them. They’re not doing that.

This is where the SBA comes in and changes everything.

The SBA goes to Chase and basically says, “Hey, if you give this person a loan, we’ve got your back.” So Chase approves your $100,000 loan. The SBA then promises Chase that if you can’t pay, they’ll give Chase $85,000 back.

Think about what just happened. Chase was gonna lose $100,000 if you defaulted. Now they’re only gonna lose $15,000. That’s way less scary for them. So suddenly they’re a lot more willing to say yes to your loan application.

The SBA typically guarantees up to 85% of the loan. Sometimes less, depends on the situation. But does this percentage really matter to you? Not really. That’s between the SBA and the bank. What does matter is whether you can realistically afford the loan, which starts by understanding your cash flow and how to calculate income need from budgeted expenses before taking on debt. The important thing you need to understand is this: the SBA doesn’t write you a check. They just make the bank feel safer about writing you one.

Types of SBA Loans: Finding the Right Fit for Your Business

There’s three main types of SBA loans you’re gonna run into. The SBA 7(a), the SBA 504, and microloans. Each one works differently. Each one is for different situations.

SBA 7(a) Loans: The Most Popular Small Business Financing Option

The 7(a) is the big dog. Most popular SBA loan out there. Why? Because it’s flexible as hell.

You can use a 7(a) loan for basically whatever your business needs. Payroll when cash flow is tight. Equipment. Inventory. Startup costs if you’re just getting going. Buying out a competitor. Renovating your space. Working capital. The list goes on.

Right now, you can borrow up to $5 million with a 7(a). That number might change later. Government changes rules sometimes. But most people aren’t borrowing anywhere close to $5 million. The average 7(a) loan is around $443,970. Still a good chunk of change.

How long do you have to pay it back? Usually 5 to 10 years. But there are exceptions. If you’re using the money to buy real estate, they might give you 25 years. Makes sense, real estate loans are bigger and you need more time to pay them off.

Interest rates come in two flavors. Fixed or variable.

Fixed rate means your rate never changes. You pay the same amount every month for the entire loan. Easy to budget for. You know exactly what’s coming out of your account.

Variable rate? That’s different. Your rate is tied to something called the prime rate, plus whatever extra percentage the lender adds on top. When the prime rate goes up, your rate goes up. When it goes down, your rate goes down, which directly affects your monthly payment. This is exactly why having clear goals is important in financial planning, as fluctuating payments require flexibility and long-term budgeting. Sometimes you’re paying more. Sometimes less.

SBA 504 Loans: Financing Real Estate and Major Equipment

Now let’s talk about 504 loans. These are more specialized.

504 loans are for buying real estate or major equipment. Think buying a building for your business. Or a huge piece of machinery that costs hundreds of thousands of dollars. That kind of stuff.

You can actually borrow more than $5 million with a 504. Depends on what you’re buying. The average 504 loan is around $1.1 million. These are bigger loans for bigger purchases.

Payback time is 10 to 25 years. Again, makes sense. If you’re buying a building, you need a long time to pay that off.

Interest rates work a bit differently here. You can get fixed or blended.

Fixed rate is the same deal as before. Rate never changes. Easy.

Blended rate means part of your loan has a fixed rate and part has a variable rate. So you’re getting a mix. Part of your payment stays the same, part can change. It’s more complicated but sometimes it works out better financially.

SBA Microloans: Small Funding for Big Dreams

Microloans are the smallest option. You can borrow up to $50,000.

These are usually for startup costs. Buying inventory. Getting supplies. Smaller equipment. Stuff like that. You cannot use a microloan to buy real estate. Can’t use it to pay off other debts either. It’s for specific business expenses.

The average microloan is only about $13,000. Not huge money. But for some businesses, that’s exactly what they need to get going.

You have up to 6 years to pay it back. Shorter than the other loans.

Microloans almost always have fixed interest rates. Your rate won’t change. But here’s the catch, microloan interest rates are typically higher than 7(a) and 504 loans. You’re paying more in interest because it’s a smaller loan and there’s more risk for the lender on small amounts. This is where a serious guide to modern money management helps, so you can decide whether paying higher interest actually makes sense for your cash flow and long-term plan.

Pros and Cons of SBA Loans: What You Need to Know Before Applying

Let’s get real about the good and bad here. Because there’s definitely both.

The Good Stuff:

SBA loans have competitive interest rates. Compared to other ways you could get money—like credit cards or merchant cash advances—SBA loans are usually cheaper. The interest rates are lower. You’re not getting killed on interest charges every month.

They’re easier to qualify for than regular bank loans. Why? Because remember, the SBA is guaranteeing part of the loan. The bank has less risk. So they’re more willing to approve people who might not get approved otherwise. If you’ve been turned down for regular bank loans before, an SBA loan might still be possible.

There’s flexibility in loan size. You can get millions of dollars if you need it. Or you can get just a few thousand. There’s options for different sized businesses and different needs.

The repayment terms are longer. Six years for microloans. Ten to 25 years for 7(a) and 504 loans. Longer terms mean smaller monthly payments. That’s easier on your cash flow, especially when you’re just starting out or going through a growth phase.

The Not So Good Stuff:

You have to give a personal guarantee. This is huge. The SBA requires business owners to personally guarantee these loans. What does that mean? It means if your business can’t pay the loan back, they’re coming after you personally. What happens to SBA loan if business closes down? Your personal assets are at risk. Your house. Your car. Your savings. All of it could be on the table. This isn’t just business debt. It becomes your personal debt if the business fails.

They might require collateral too. Depending on the loan size and your situation, they might want you to put up assets as collateral. Equipment, property, whatever you’ve got. If you don’t pay, they take the collateral.

The approval process takes forever. This is a big one. Getting an SBA loan isn’t quick.

SBA Loan Approval Timeline: How Long Does It Really Take?

Let me give you the real numbers on how long this takes.

For a 7(a) loan: You’re looking at about 2 to 4 weeks from when you apply to when you actually get the money. That’s if everything goes smooth. If there’s issues with your paperwork or they need more information, add more time.

For a 504 loan: Two to four months. Yeah, months. These are bigger loans for real estate and major equipment, so there’s more due diligence involved. More paperwork. More waiting.

For microloans: About 2 to 7 weeks. Faster than a 504, but still not quick.

Here’s the thing. Imagine you apply for an SBA loan. You wait all this time. Two weeks. Four weeks. Two months. Whatever. And then they reject you. All that time wasted. You still don’t have the money you needed. Your business problems are still there, just worse now because you lost all that time.

That’s why it’s so important to know your chances before you even apply. Don’t waste weeks or months on an application that’s probably gonna get rejected anyway.

SBA Loan Eligibility Requirements: Do You Qualify?

Let’s go through who can actually get these loans. There’s specific requirements.

You have to be a for-profit business. Your business needs to be registered and operating to make money. Nonprofits don’t qualify for SBA loans. If you’re running a charity or nonprofit organization, these loans aren’t for you.

You have to operate in the United States. Your business has to be located here. Or in US territories. If you’re running a business in another country, no dice.

You have to meet the SBA’s definition of a “small business.” This is based on your industry, your revenue, how many employees you have, stuff like that. Different industries have different size standards. The SBA has a tool on their website where you can check if your business counts as small or not. Go use it before you waste time applying.

You need owner equity investment. Fancy term for something simple. You have to have skin in the game. You need to have already invested your own time or money into this business. They want to see you’re serious about this. You’re not just looking for free money with zero risk to yourself.

You have to prove that you can pay back the loan. The business needs to show it can actually make the payments. If you are already running your business, lenders will look at your financial estimates and current income. They will also check your credit history and business plan. On top of that, having a strong emergency fund as your financial foundation gives lenders confidence that unexpected expenses won’t mess up your payments.

You have to try other financing options first. The SBA wants to see that you attempted to get money somewhere else. Why? Because SBA loans are meant for businesses that can’t get regular loans under reasonable terms. If you could get a regular bank loan without the SBA guarantee, you should do that instead. You need to show you tried and couldn’t get approved elsewhere.

The loan has to be used for approved purposes. The money you get from an SBA loan has to go toward legitimate business purposes. You can’t use it for personal stuff. Can’t use it to pay yourself a huge salary. Can’t use it for things unrelated to the business. There are rules about what the money can and can’t be used for.

Your industry has to be eligible. Some industries are automatically disqualified. Pyramid schemes obviously don’t qualify. Gambling operations don’t qualify. Lobbying firms don’t qualify. Businesses involved in illegal activities don’t qualify. There’s a list of ineligible industries. Make sure yours isn’t on it before you apply.

Credit Score and Financial Requirements for SBA Loans

Beyond those basic eligibility requirements, there’s financial stuff they’re gonna look at closely.

Your credit score matters. Like, really matters. Different lenders have different requirements, but generally you need at least a 650 credit score. Below that and you’re probably not getting approved. The higher your score, the better your chances. If your score is in the 700s or 800s, you’re in much better shape.

They’re gonna review your cash flow. Either your current cash flow if you’re already in business, or your projected cash flow if you’re starting up. They need to see money coming in that can cover the loan payments plus your other business expenses.

Collateral might be required. This is more common for loans over $25,000. They want something to seize if you don’t pay. Property, equipment, inventory, whatever you’ve got that has value.

Owners with 20% or more stake have to personally guarantee the loan. If you own 20% or more of the business, you’re signing that personal guarantee. You and any other major owners are all on the hook personally. Going back to what happens to SBA loan if business closes down—all you major owners are personally responsible.

Some loans require a down payment. Anywhere from 10% to 30% down. That’s money you have to pay upfront before you get the rest of the loan.

Understanding SBA Loan Down Payments

Let’s talk about down payments for a second because people get confused about this.

A down payment on an SBA loan is money you pay upfront when you get the loan. Think of it like a security deposit when you rent an apartment. It’s your money going in first.

Why do lenders want this? Two main reasons.

One, it lowers their risk. If you’ve already put down $10,000 or $20,000 of your own money, you’re way less likely to just walk away from the loan. You’ve got your own money invested.

Two, it shows you’re serious. You’re not just looking for a handout. You’re willing to put your own cash on the line.

Here’s how it works in practice. Say you get approved for a $100,000 loan with a 10% down payment. You have to come up with $10,000 before you receive the remaining $90,000. You don’t get the full hundred grand all at once. You pay your ten grand first, then they release the ninety thousand to you.

4 Expert Tips for Getting Approved for an SBA Loan

Let me give you some advice that actually matters. Not theory. Real stuff that can help you.

First – fix your credit score if it’s low.

Low credit score will kill your chances. Seriously. Before you even think about applying, go check your credit reports. You can do this completely free. Don’t pay for it.

Look for errors. Mistakes happen all the time. Wrong information. Accounts that aren’t yours. Paid-off debts still showing as open. I’ve seen it a million times.

I did this myself years ago. Found an error on my report. Disputed it. Got it corrected. My credit score jumped 100 points in a matter of days. Not exaggerating. Literally 100 points. That’s the difference between getting rejected and getting approved right there.

So go pull your reports. Check them carefully. Fix any errors you find. It could change everything.

Second – shop around for lenders.

Not all lenders are the same. This is huge and people don’t realize it.

Some lenders love restaurants. Others think restaurants are too risky and won’t touch them. Some lenders prefer retail businesses. Others like service companies. Some like construction. Everyone has their preferences.

One bank rejects you? Go try another one. Then another one after that if you need to. Different lenders have different appetites for different types of businesses. What one bank sees as too risky, another bank might see as a great opportunity. Don’t give up after one rejection.

Third – consider an SBA Express loan if you need money fast.

There’s something called an SBA Express loan. It’s faster than a regular SBA loan. If you need money quickly, this might be the way to go.

But there’s a catch. You can only get up to $500,000 this way. So if you need more than that, Express isn’t an option.

There’s pros and cons. The pro is obvious, faster approval. You can get approved in days instead of weeks or months. The con? Higher interest rate than a standard SBA loan. You’re paying extra for the speed. You need to decide if that trade-off is worth it for your situation.

Fourth – read the terms and conditions. Every single word.

This goes for any loan, not just SBA loans. But seriously, read everything.

Don’t just skim through and sign. Actually read every page. Look for guarantee fees. Look for prepayment penalties. Look for hidden costs that pop up later. Understand exactly what you’re agreeing to.

I’ve seen too many business owners get surprised by fees they didn’t know about. Or penalties they didn’t expect. All because they didn’t read the contract carefully. Don’t be that person.

Where to Apply for an SBA Loan: Your Best Options

So where do you actually go to get one of these loans?

Three main places. Banks. Credit unions. Online lenders.

Most people start with their own bank or credit union. The place where they already have their business checking account. This makes sense. You already have a relationship there. They know you. They’ve seen your account activity. You’re not just a stranger walking in off the street. That existing relationship can help your chances.

Online lenders are another option. Online lenders usually have faster approvals than traditional banks. The whole process is more streamlined. Everything’s done online. And honestly, the qualifications are often easier with online lenders. They might approve you when a traditional bank wouldn’t. Don’t overlook online options just because they’re not a physical bank you can walk into.

You can also go to the SBA’s website directly. They have a lender match tool. It helps you find lenders in your area who do SBA loans. You just enter some basic info and it shows you options. It’s free to use and can save you time.

Final Thoughts on SBA Loans

Look, SBA loans can be great for small businesses. The rates are competitive. The terms are long. You can get significant amounts of money that you might not be able to get elsewhere.

But they’re not perfect. The approval process is slow. You’re giving a personal guarantee which means your personal assets are at risk. And if things go wrong with your business, you need to understand what happens to SBA loan if business closes down, you’re still responsible for paying it back personally.

Go into this with your eyes open. Understand what you’re signing up for. Do your homework. Check your credit. Shop around. Read everything. Make sure this is really the right move for your business.

Getting funding for your business is a big deal. It can help you grow. It can help you survive a rough patch. It can help you take advantage of opportunities. But it’s also debt. It’s money you have to pay back with interest. Make sure you’re ready for that responsibility before you sign anything.

FAQs About SBA Loans

1. What is the 20% rule for SBA?

The SBA 20% rule means that anyone who owns 20% or more of a business must personally guarantee the loan. This ensures that major owners are personally responsible for repayment if the business fails, reducing risk for lenders.

2. What is the easiest SBA loan to qualify for?

The SBA Microloan is generally the easiest to qualify for. It offers loans up to $50,000 for startups and small businesses with simpler requirements, though it often comes with slightly higher interest rates and shorter terms.

3. How to prepare for an SBA loan?

Start by improving your credit score, organizing financial documents, and creating a solid business plan. Review your cash flow, gather tax returns, and ensure you can show the ability to repay. It also helps to explore lenders familiar with SBA loans.

4. How do you qualify for an SBA loan?

To qualify, you must run a for-profit U.S.-based business, meet the SBA’s size standards, have invested equity in your business, and demonstrate the ability to repay. You must also have tried and been unable to get conventional financing first.

5. What is the maximum loan amount from SBA?

The maximum SBA loan amount is $5 million, typically available under the SBA 7(a) and 504 programs. However, the amount you qualify for depends on your business’s financial strength, purpose, and repayment capacity.

6. What four things make you eligible for an SBA loan?

You must:

-

Operate a for-profit business in the U.S.

-

Meet SBA size standards.

-

Have invested personal equity in the business.

-

Show the ability to repay the loan based on financials and creditworthiness.

7. What is the minimum down payment for an SBA loan?

Most SBA loans require a down payment of 10% to 20%. The exact amount depends on the loan type and lender. A higher down payment can improve your approval chances and possibly secure better loan terms.

8. What documentation is needed for an SBA loan?

You’ll typically need business and personal tax returns, financial statements, a business plan, bank statements, and legal documents such as licenses, leases, and ownership agreements. Lenders may also request collateral details and personal financial information.